What’s the 50/30/20 Budget Rule & Home Saving Tips

by Tyler Castle

6 min read

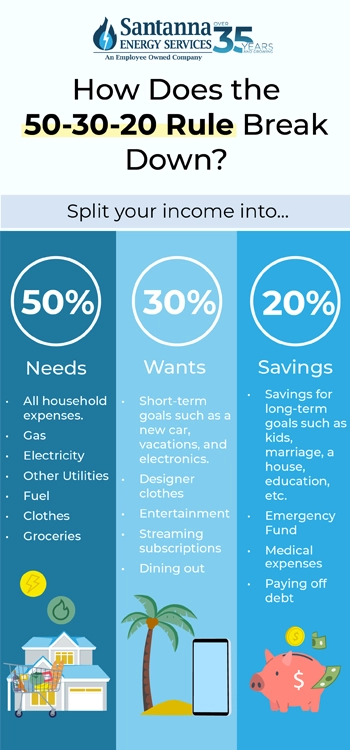

In the realm of personal finance, the 50/30/20 budget rule has emerged as a practical guideline for managing finances. This rule allocates percentages of income providing a structured approach to financial stability.

We’ll look at the details of the 50/30/20 budget rule and find more ways to save money for your goals. As a bonus, we’ll share practical tips on how to save for your home expenses. Let’s navigate the landscape of budgeting and savings to empower your journey toward a more secure financial future.

What is the 50/30/20 rule?

The 50/30/20 rule is a popular and straightforward budgeting principle designed to help individuals manage their finances. The rule divides your after-tax income into three distinct categories: 50% for essential needs, 30% wants, and 20% for savings and debt repayment.

This rule assists in creating a balanced financial plan that ensures the fulfillment of basic necessities and more. Embracing the 50/30/20 rule can serve as a practical guide for individuals seeking a structured budget. Here’s a closer look at the components of this rule:

50% needs

The 50% portion encompasses essential expenditures crucial for maintaining a basic standard of living. These necessities typically include housing, utility bills, and health insurance. Here’s an expanded list of items that fall into this category:

- Electricity

- Gas

- Water

- Groceries

- Food

- Car payments

- Essential clothes

- House payments

30% wants

In the 50 30 20 rule, the 30% allocated to “wants” encompasses spending money on optional items. This allows individuals the flexibility to indulge in personal preferences and lifestyle choices. This portion covers expenditures on non-essential items and activities. Here’s an expanded list of items that fall into this category:

- Dining out

- Entertainment such as movie tickets, concerts and streaming services

- Gym memberships and fitness classes

- Vacation and travel expenses

- Gadgets and electronics

20% savings and debt

What percentage of your paycheck should you save? This is where the 20% of the 50/30/20 budget rule comes in. This portion is earmarked for building a robust financial foundation. It encompasses contributions to retirement accounts, other long-term savings goals and emergency funds.

As a rule of thumb for emergency funds, Chase Bank recommends you save anywhere from 3 to 6 months of living expenses. Here’s an expanded list of items that fall into this category:

- Savings for future kids

- Savings for a future home purchase

- Paying off student loans

- House payments

- Health savings

- Investments

Benefits of using this rule

Implementing the 50/30/20 rule offers numerous benefits for individuals seeking financial stability. Here are some of the benefits of this rule:

- The 50/30/20 rule provides a straightforward and easy-to-follow framework that’s fast to implement into your budget plan.

- By allocating percentages to needs, wants, and savings, the rule ensures a balanced approach to financial priorities.

- The rule promotes saving for future goals such as homeownership, education, or retirement.

- Consistent savings and investment contribute to wealth accumulation over time.

- Following the 50/30/20 rule can contribute to improved financial literacy.

How to adopt the 50/30/20 budget rule

You can adopt the 50/30/20 rule in a number of ways. The first step to adopting this rule is to tally up your after-tax income. This determines the exact amounts to allocate to needs, wants, and savings. Next, identify essential needs ensuring they do not exceed 50% of your income.

Then, allocate 30% to discretionary spending and finally, commit 20% of your income to savings. This might seem a little overwhelming at first, but there are resources out there to help you implement this rule. Skip the pencil and paper and go digital with a 50/30/20 rule spreadsheet.

If you prefer the handwritten and printable approach, consider downloading a 50/30/20 budget sheet. No matter which approach you choose, having a place to keep track and store your finances is a great way to keep tabs on how your budget is shaping out.

How to use the 50/30/20 rule to your advantage

You can start by meticulously tracking your expenses to identify where your money is going and assess if adjustments need to be made. When planning a budget, the biggest consideration should be how to prioritize building an emergency fund and paying off outstanding debts. This budget rule helps you do just that by setting a portion of your income towards these priorities.

Regularly review and adjust your budget as necessary to stay on track and make progress toward your financial objectives.

Alternatives to this rule

If this budgeting strategy doesn’t work for you, that’s okay, you can still budget without using the 50/30/20 rule:

- Use the Envelope System: use envelopes to allocate cash for different spending categories, ensuring you stick to predetermined limits.

- Pay Yourself First Budgeting: Automatically setting aside a fixed percentage or amount of income for savings and investments before allocating the rest to expenses.

- Cash-Only Budgeting: Restricting spending to cash transactions only.

- Bi-Weekly Budgeting: Budgeting on a bi-weekly basis, aligning with most people’s pay schedules.

- Priority-Based Budgeting: Ranking expenses by importance and allocating funds accordingly.

- Use a Good Old Fashion Savings Chart: A savings chart provides a visual representation of progress, making it easy to see how close you are to reaching your savings goals.

The importance of savings

Saving provides a safety net against unexpected expenses and emergencies, offering peace of mind knowing that funds are available to cover unforeseen circumstances. Moreover, saving allows individuals to pursue their long-term financial goals. It also enables individuals to seize opportunities for investment and wealth-building, laying the foundation for future financial growth and prosperity. Additionally, saving instills discipline and financial responsibility, fostering healthy financial habits and resilience in the face of economic challenges.

Is the 50/30/20 rule worth it?

Whether the 50/30/20 rule is “worth it” depends on individual circumstances, financial goals, and personal preferences. For many people, the 50/30/20 rule provides a straightforward and practical framework for budgeting that promotes financial stability and long-term planning.

The effectiveness of the rule may vary depending on factors such as income level, cost of living, debt obligations, and individual priorities. Some individuals may find that they need to adjust the percentages or adopt alternative budgeting methods to better suit their needs.

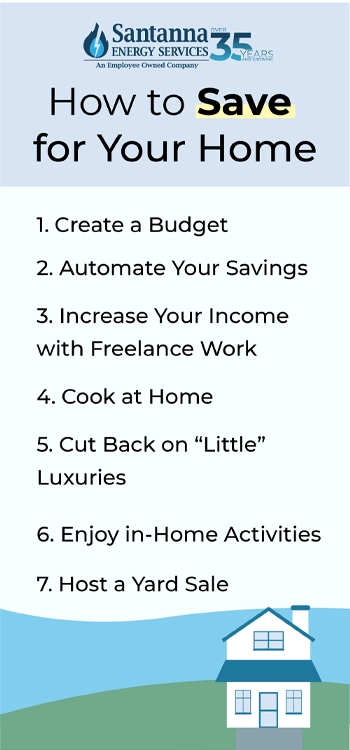

Tips on how to save for your home

One of the most common reasons individuals use the 50/30/20 rule is to save for long term goals. If you’re looking for tips on how to save for a home, check out this list:

- Create a Budget: Establish a budget that outlines your income, expenses, and savings goals, ensuring you allocate funds towards saving for your home.

- Automate Your Savings: Set up automatic transfers from your checking account to a dedicated savings account specifically for your home fund.

- Increase Your Income: Explore opportunities to boost your income, such as taking on a part-time job, freelancing, or selling unused items.

- Cook at Home: Cut down on dining out expenses by cooking meals at home.

- Cut Back on “Little” Luxuries: Cut down on small expenses like going out for coffee or leaving your phone charger plugged in when it’s fully charged.

- Enjoy in-Home Activities: Instead of going out on costly outings, opt for cozy nights in.

The 50/30/20 budget rule offers a structured approach to financial management, guiding individuals to allocate their income effectively! By adhering to this rule, individuals can achieve greater financial stability and prioritize essential expenses.

Tyler is an experienced energy professional, having worked for Santanna Energy Services, for the past four years. He is passionate about renewable energy and believes that diversifying the energy grid is the key to a sustainable future. Tyler is dedicated to supplying consumers with the best possible energy solutions and works diligently to make sure that Santanna can deliver the highest quality service.