10 Ways to Take Control of Your Budget This Year

by Tyler Castle

9.2 min read

As a homeowner, it’s important to practice mindful spending for a comfortable and stress-free home environment. We get it, budgeting for your home expenses can be difficult if you don’t know where to start. Between deciding what’s essential to what you should cut back on, budgeting isn’t complicated with the right tools and tips!

Keep in mind, that these budgeting strategies aren’t exclusive to home finances. These tips can apply to other financial aspects of your life like personal finances, vacation budgeting, and more!

What are the main purposes of a budget?

The main purpose of a budget is to aid individuals and families in skillfully managing their income and expenses. In the same way, budgeting allows individuals to use tools and strategies to allocate funds for specific needs. Most importantly, a budget ensures that income is used wisely for priorities like savings and essential living expenses.

Using budgeting strategies and developing a plan can help individuals stay accountable for their expenses and monitor their spending.

How can you budget money for beginners? You don’t have to be a mathematician to use these tips and get a handle on your budget. Take control of your budget, with our top 10 tips:

1. Create a realistic budget

Creating a realistic budget allows you to gain a clear understanding of your income and expenses. Sifting through and organizing your expenses provides a realistic snapshot of your financial situation.

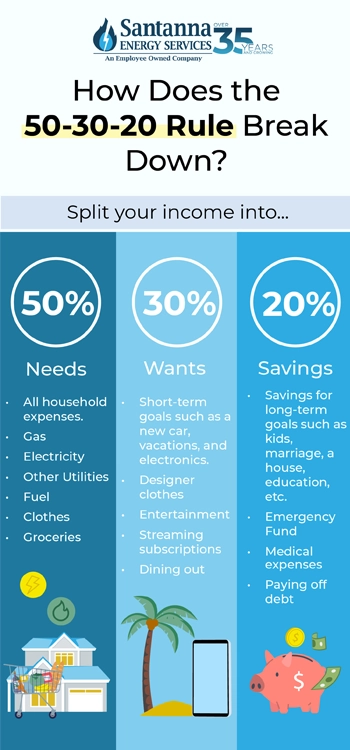

But how do you create a budget? When planning a budget, the biggest consideration should be if you’d like to use the 50-30-20 rule. Simply enough, this rule recommends putting 50% of your income towards your needs, 30% towards your wants, and 20% towards savings. If you’re not sure where to start with your budget planning, the 50-30-20 rule is a great benchmark to use!

Here’s a closer look at what this breaks down to:

Most importantly, it’s important to create a realistic household budget for your home. A realistic household budget helps you prioritize essential needs and ensure critical expenses are covered. Moreover, budgeting your household expenses can prepare you for unexpected situations like electrical fires and storms.

But, how can you create a household budget? Here are some steps to help:

- Start by listing all your sources of income, including salaries, freelance work, or any additional income streams.

- Document all your monthly expenses and split them us using the 50-30-20 rule by importance. Make decisions where you can cut back on and allocate that money to other important expenses.

- Set a realistic budget for your expenses and establish a realistic savings budget.

- Constantly monitor and track your spending and adjust as needed.

While these steps are just a possible plan you can use, each financial situation is different, so adjust accordingly.

2. Track your spending and progress

Why is tracking your expenses throughout the month important? Tracking your expenses, especially at a monthly level, allows you to see where your money is going in real-time. This provides valuable insights into spending patterns and habits. Keeping a continuous record, can help identify potential areas of overspending and make timely adjustments to stay on budget.

Regular tracking of your budget enhances your ability to plan for upcoming bills and anticipate financial needs. But of all you can you online spreadsheets like excel and Google Sheets to track your budgeting in real time! You can also set up formulas to adjust your data as you record it.

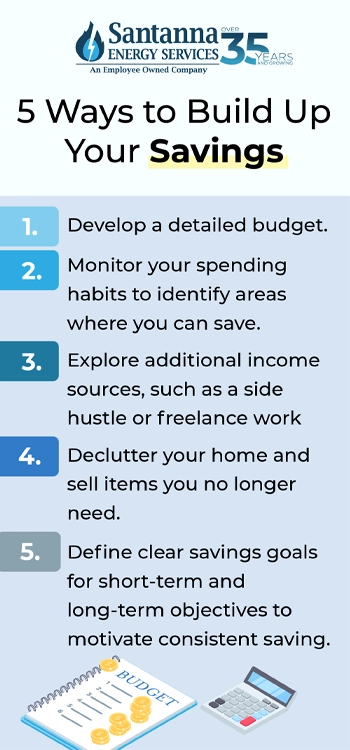

3. Build up your savings

Firstly, having a savings cushion provides a financial safety net, offering protection against unexpected expenses or emergencies. Additionally, by consistently contributing to your savings, you create a disciplined savings habit that reinforces responsible financial behavior. It enables you to work towards both short-term and long-term financial goals.

4. Plan an emergency fund

An emergency fund acts as a source of financial security, reducing stress and providing peace of mind. The size of your emergency fund will vary depending on your lifestyle and income. As a rule of thumb, Wells Fargo recommends putting away at least three to six months of living expenses.

By setting aside funds specifically for unexpected situations, you reduce the need to rely on credit cards or loans. Creating an emergency fund can help you avoid accumulating high-interest debt if you get into trouble.

5. Pay your bills on time

Timely bill payments help you avoid late fees and penalties and also contributes to a positive credit history. Consistently meeting payment deadlines demonstrates financial responsibility, opening doors to favorable interest rates on housing loans and credit cards. By prioritizing on-time bill payments, you ensure that your budget remains predictable and manageable, preventing financial strain.

We get it, you’re busy during the month and might have trouble remembering to pay your bills on time. Here’s some tips to ensure your bills are paid on time and your budget stays intact:

- Schedule automatic payments for your bills through your bank or the service provide.

- Use your calendar app to set up reminders and alarms for bill due dates.

- Develop a weekly or monthly bill payment schedule. Allocate specific times to review and pay bills to maintain consistency.

- Most service providers offer the option to receive email or text alerts for upcoming bill payments. Enroll in these notifications to stay informed.

- Place sticky notes on your refrigerator or any prominent location to visually remind you of impending bill due dates.

- If you can, align bill due dates with your payday. This makes it easier to budget and ensures your funds are available when payments are due.

6. Pay off your debt

By reducing outstanding balances, you minimize the burden of high-interest payments. Certain types of debt have lower interest rates than others. The faster you pay your debt off, you lower the risk of owing more money later. You also free up resources for other essential aspects of your budget.

Successfully managing and eliminating your debt not only enhances your financial health but also contributes to improved credit scores. Moreover, as debt decreases, you gain a sense of financial empowerment and flexibility. Most importantly, funds previously allocated for debt payments can be redirected towards other areas of saving.

7. Create money-saving strategies and practice discipline

When wondering, “How do I stick to a budget?” establishing effective savings tactics becomes the answer. Developing a clear plan for allocating funds wisely is crucial especially if you’re a homeowner with monthly bills. Here are some additional easy money saving strategies you can practice to ensure you stick to your budget:

- Cook at Home: Reduce dining out expenses by preparing meals at home, which is often more cost-effective and healthier.

- Limit Impulse Purchases: Do you really need two Stanley cups? Implement a waiting period before making non-essential purchases to avoid impulsive buying decisions.

- Use the Elevope System: Use envelopes to represent particular budget categories, such as groceries, entertainment, or dining out.

- Buy Generic Brands: Opt for generic brands instead of name brands to save money without sacrificing quality.

- Utilize Discounts and Coupons: Take advantage of discounts and promotions when shopping for both everyday items and larger purchases.

- Limit Convenience Spending: Cut back on convenience purchases like ordering meal or grocery delivery services that have extra fees.

- DIY Repairs and Maintenance: Learn basic do-it-yourself skills for minor home repairs and maintenance tasks.

- Use an Expense Tracker: Having a physical place where you can write down and track your expenses as they happen helps you stay on top of your budget.

These ideas are just the start of how you can live on a budget!

8. Shop with a list

A list helps you stay focused on purchasing only the items you need. By creating a detailed list before heading to the store, you can plan your purchases based on your budget and specific needs. This method not only streamlines the shopping process but also minimizes the temptation to deviate from your financial plan.

9. Start an investment strategy

Allocating a portion of your income towards smart investments not only cultivates a disciplined savings habit, but can potentially generate additional income over time. Investments such as stocks, bonds, or real estate can serve as vehicles for wealth. Investing can provide a means to grow your financial resources beyond traditional savings accounts. Implementing an investment strategy requires thoughtful consideration and planning, aligning with your financial goals and risk tolerance.

10. Choose things for your home and lifestyle that are realistic for your budget

Once you’ve established how you’ll budget your income, the last step to planning your budget is to choose and eliminate things that are right for your lifestyle and realistic for your budget. Making smart choices with money prevents unnecessary debt and financial stress by staying within your budget. By embracing a lifestyle that is financially sustainable, you can gain control over your budget. Here are some examples:

Costly Alternative |

Budget-Friendly Alternative |

| Fluctuating Monthly Energy Plan: | Predictable Energy Plan: |

| Unpredictable monthly energy costs. | Pay the same monthly amount. * |

| Potential for higher bills during peak seasons. | Consistent payments regardless of seasonal changes. |

| Brand-New Furniture: | Secondhand or Refurbished Furniture: |

| High retail prices for new items. | Affordable options with character and history. |

| Rapid depreciation in value. | Sustainable choice, reducing environmental impact. |

| Gourmet Coffee Shop: | At-Home Coffee Brewing: |

| Daily expenses on pricey coffee drinks. | Investment in a quality coffee maker for long-term savings. |

| Cumulative high costs over time. | Enjoying gourmet coffee in the comfort of your home |

| Regular Dining Out: | Home-Cooked Meals: |

| Costly restaurant bills. | Reduced food expenses through meal planning. |

| Limited control over ingredients and portions. | Healthier eating habits and financial savings. |

| Gym Membership: | Home Workouts or Outdoor Activities: |

| Monthly subscription fees. | No-cost or low-cost exercise alternatives. |

| Limited flexibility in workout times. | Customizable routines at your convenience. |

* Restrictions apply. Enrollment based upon program eligibility. Customers using more than 125% of normal monthly usage as determined by Santanna may be required to switch plans.

Why is having a household budget important?

As a homeowner, having a specific household budget helps provide a clear overview of your financial situation. This awareness enables informed decision-making and allows you to prioritize essential needs and savings. Additionally, a household budget provides a platform for open communication about finances within a family or among household members.

Mastering the art of budgeting is a transformative journey that empowers individuals to take control of their financial destinies. We hope we’ve provided you a roadmap for cultivating financial discipline, fostering savings, and achieving long-term financial goals. By incorporating these steps into your daily life, you can experience a newfound sense of financial freedom and security.

Santanna Energy Services is a supplier of earth-friendly natural gas plans in the United States, providing services to Illinois, Indiana, Pennsylvania, Michigan, and Ohio. We provide a wide range of energy services and products to meet the needs of both residential and small business customers. Our mission is to provide innovative and cost-effective energy solutions that will help our customers achieve their energy goals. With over 35 years of experience, we are committed to creating life-long relationships by providing quality service to customers, communities, and employees.

Tyler is an experienced energy professional, having worked for Santanna Energy Services, for the past four years. He is passionate about renewable energy and believes that diversifying the energy grid is the key to a sustainable future. Tyler is dedicated to supplying consumers with the best possible energy solutions and works diligently to make sure that Santanna can deliver the highest quality service.