How to Save for a House: Smart Financial and Energy Habits for Midwest Homeowners

by Tyler Castle

18.4 min read

Buying a home in the Midwest is a big milestone, but getting there (or settling in) comes with plenty of "Where do I even start?" moments. Between figuring out how to save for a house, managing bills, and keeping up with heating and cooling costs through unpredictable seasons, it's easy to feel like your budget is always one step behind.

Whether you're saving for your first home or adjusting to life as a new homeowner, small financial and energy decisions can make a big difference. The good news? You don't need a complete lifestyle overhaul to see results, just a smarter plan.

We've supplied electricity and natural gas for thousands of new homeowners settling into their first homes. A lot is involved in homeownership, and we're here to provide tips to help you save for your dream home!

In this guide, we'll walk you through simple, realistic ways to save for a house, estimate costs in your state, and build energy habits that keep your home and wallet running efficiently. Ready to make every dollar count toward your dream home? Let's dive in.

Key Points of This Article:

- Midwest states offer lower home prices, a lower cost of living, and strong job markets, making the region one of the most practical places to become a homeowner.

- With average Midwest incomes between $62,280 and $69,020, it can take about 7-8 years to save a full 20% down payment.

- Simple energy habits like switching to LED bulbs, sealing air leaks, adjusting your thermostat, washing clothes in cold water, and maintaining your HVAC system can save $25-$50 a month.

Why the Midwest Is a Great Place to Buy a House

The Midwest is one of the best places to buy a home because it offers affordability, stability, and space without sacrificing comfort. Home prices across states like Ohio, Michigan, Illinois, and Pennsylvania are often 30% cheaper than those in major coastal metros, giving buyers more room for their money.

The overall cost of living is also lower, from housing and groceries to everyday utilities.

However, as electricity rates continue to rise steadily, access to reliable energy solutions helps homeowners manage their budgets with greater peace of mind. Add in steady job markets, strong community values, and the charm of four distinct seasons, and it's easy to see why so many people choose to plant roots here.

In the Midwest, owning a home isn't just a dream; it's a practical, attainable goal that supports both financial security and everyday quality of life.

Factors to Consider Before Buying a House in the Midwest

Before you jump into buying a home in the Midwest, it helps to look at the whole picture, not just the price tag. Everything from your finances to the neighborhood to the condition of the home can shape your comfort and stability for years to come.

Here's what to think about as you start your search:

Financial Considerations

- Start by setting a realistic budget based on your income, savings, and expenses. Remember that homeownership includes more than just the purchase price; you'll also need to think about property taxes, insurance, utilities, and ongoing maintenance.

- Check your credit score and existing debts, since lenders use these to determine your loan options and interest rate. Avoid taking on new debt or large purchases until after you close on your home.

- It's also smart to get pre-approved for a mortgage before house hunting. This gives you a clear idea of what you can afford and strengthens your offer when you find the right home.

- Finally, decide how much to put down for your down payment. The amount you choose affects your loan terms, monthly payment, and whether you'll need to pay for mortgage insurance.

Location and Community

- Take time to research the local housing market in your target area. Look at recent sales and price trends to understand what's typical for homes similar to the one you're considering.

- Pay attention to the neighborhood's overall quality and convenience because your commute, nearby schools, grocery stores, healthcare facilities, and public transportation can all impact your day-to-day life.

- Also, check for future development plans in the area. New businesses, schools, or road expansions can increase property values, while nearby industrial or commercial projects might affect noise levels or traffic.

Property Details

- A professional home inspection is one of the most valuable steps you can take. Inspectors can identify structural or mechanical issues early, saving you from unexpected repairs down the road.

- Take a close look at the home's condition as well. Uneven floors, cracks in the foundation, or drafty windows can signal deeper problems that may need attention.

- Lastly, consider your long-term needs. Think about whether the home fits your future plans, such as space for a growing family, a home office, or accessibility as you age. Choosing a home that supports your lifestyle now and in the future will help you avoid costly moves or renovations later.

How Much Should You Save for a House?

When you start figuring out how much to save for a house, it helps to break your goal into clear parts. You should save enough for your down payment, closing costs, moving expenses, and a separate emergency fund. Together, these four pieces make up the total amount you need before you are ready to buy.

According to The Mortgage Reports, most buyers aim to save at least 20% of the home's price for a down payment to avoid extra fees like private mortgage insurance. You should also plan for 2–5% of the purchase price for closing costs and a few thousand dollars for moving and setup expenses.

Finally, keep a separate emergency fund with three to six months of living expenses to protect yourself from unexpected repairs or income changes.

How Long Does It Take to Save for a House?

It can take 7-8 years to save a full down payment. Some buyers reach their goal faster by cutting expenses, earning extra income, or using homebuyer programs, while others shorten the timeline by aiming for a smaller down payment. Everyone's situation is different, but having a clear target and staying consistent makes the path to homeownership much more achievable.

For many households, saving for a 20% down payment (the most common percentage needed to buy a house) takes time, but understanding the numbers makes the process easier. Most Midwest states fall well below the national average home price of about $363,932, with many homes in the region ranging from $258,642 to $283,509.

A 20% down payment on a home in that range is roughly $52,000 to $56,000. With average household incomes between $62,280 and $69,020, saving 10% of your income each year means putting away about $6,200 to $6,900 annually.

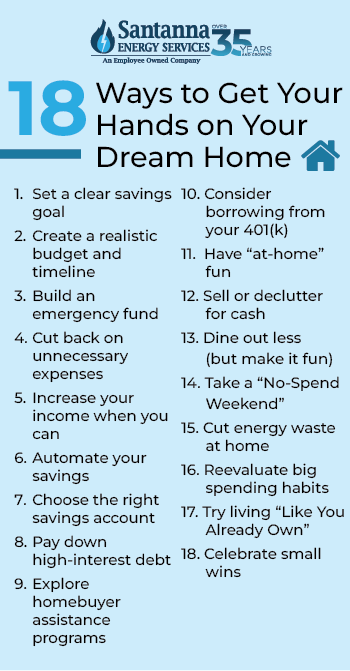

How to Save for a House: 18 Ways to Get Your Hands on Your Dream Home

Saving for a house is not about giving up everything you enjoy. It is about building steady habits that support your goal. Whether you are renting an apartment in Ohio or living with family in Pennsylvania to save faster, every dollar you set aside and every expense you lower brings you closer to your future home.

Here are the smart, realistic ways to save, from setting a budget that actually fits your life to finding the best savings accounts and homebuyer programs available right here in the Midwest:

1. Set a Clear Savings Goal

Start by deciding exactly how much you need. Include the down payment, closing costs, moving expenses, and a little extra for essentials like furniture. Many buyers save around 20% of the home's price to avoid private mortgage insurance, but if you are buying your first home, starting with 5-10% is perfectly fine. A clear number gives you direction and helps you stay consistent.

2. Create a Realistic Budget and Timeline

Take a close look at your income and monthly bills, then decide how much you can comfortably set aside each month toward buying a home. You don't have to cut out every fun thing, but tracking where your money goes helps you see what's possible.

The 28/36 rule is a helpful guide. It suggests that no more than 28% of your income should go to housing, and all debts combined should stay under 36%. This helps you understand what you can handle long term.

3. Build an Emergency Fund

Before putting everything toward your home savings, build a small safety net of three to six months' worth of expenses. Think of it as your "just in case" fund. If your car needs repairs or an unexpected bill shows up, you won't have to dip into your home savings. It gives you peace of mind now and protects your progress later.

4. Cut Back on Unnecessary Expenses

It's not about cutting everything, but just trimming the extras. Try these small swaps:

- Skip that daily $6 coffee and make it at home.

- Say no to impulse buys by waiting 24 hours before checking out.

- Cancel unused subscriptions or free trials before they renew.

- Pack lunch from home three days a week.

- Choose free weekend plans — park walks, library trips, or game nights.

These small adjustments can easily save you $100–$300 a month.

5. Increase Your Income When You Can

Sometimes, the fastest way to save more is to earn more. Look for opportunities to boost your income without burning out. You could:

- Ask for a raise if you've been performing well at work.

- Take on overtime or freelance projects.

- Start a side hustle like pet sitting, tutoring, photography, or reselling items online.

- Offer services you are already good at, like baking, editing, or basic handyman work.

Even an extra $300 a month adds up to $3,600 a year, enough to cover moving expenses or part of your closing costs.

6. Automate Your Savings

Set a recurring transfer from your checking to savings account right after payday. Treat it like a bill to your future self. Over time, you will barely notice the money leaving your account, but your savings will grow steadily.

7. Choose the Right Savings Account

Put your savings in a high-yield account that earns more interest than a regular one. The goal is to make your money work for you, even while it's sitting still. Look for an account with no fees and easy access when it's time to make your purchase. This simple move helps your savings grow faster without any extra effort on your part.

8. Pay Down High-Interest Debt

If you have high-interest debt or credit card balances, start paying those down before you buy a home. Less debt means more room in your budget and a better credit score, which can help you qualify for lower mortgage rates. In the short term, it might feel like a slow process, but in the long run, you'll save thousands and make homeownership more affordable.

9. Explore Homebuyer Assistance Programs

Many states offer programs that help cover down payments or closing costs. These programs can lower the amount you need to save and shorten your timeline. A little research can save you thousands.

10. Consider Borrowing from Your 401(k)

While it's not the ideal way to fund your home purchase, the IRS does allow you to borrow from your employer-sponsored 401(k) to help buy a primary residence. This option can give you access to funds quickly if you're short on savings, but it should be used with caution.

In most cases, you can borrow up to half your vested balance or $50,000, whichever is lower. You must repay the loan within five years, and leaving your job before it is repaid can result in penalties. Talk to a financial advisor before choosing this option.

11. Have "At-Home" Fun

Entertainment doesn't have to break the budget. Plan movie nights at home, cook together, or host a potluck with friends instead of going out. It's cozy, personal, and just as fun while helping you save that $100 dinner bill.

12. Sell or Declutter for Cash

Walk through your home and gather items you no longer use. Electronics, furniture, clothes, and collectibles can all be sold online. You'll make extra money and lighten your load for the move ahead.

13. Dine Out Less (But Make It Fun)

You do not need to stop eating out altogether, just be intentional. Try going out once or twice a month or switch to lunch instead of dinner to save 30–40%. Make staying in enjoyable with theme nights, like pasta night or taco Tuesday, and you won't miss dining out as much.

14. Take a "No-Spend Weekend"

Choose one weekend each month where you commit to spending nothing. Focus on free activities and give your wallet a break. This helps reset your spending habits and appreciate what you already have.

15. Cut Energy Waste at Home

Energy-smart habits save money now and after you buy your home. Switch to LED bulbs, unplug electronics you are not using, and seal gaps around windows and doors. The savings can go straight into your home fund.

16. Reevaluate Big Spending Habits

Take a look at your bigger patterns. Are you upgrading your phone every year? Leasing new cars often? Keeping too many streaming services? Cutting just one of these can free up hundreds of dollars annually.

17. Try Living "Like You Already Own"

Start practicing what your future mortgage budget will feel like. If you expect your future home payment to be $300 more than rent, set that extra $300 aside every month now. You'll adjust faster and build savings quicker.

18. Celebrate Small Wins

Saving for a home takes time, so celebrate the little milestones. Maybe you hit your first $1,000 or finally paid off a credit card. Treat yourself in small, meaningful ways that don't set you back, like a nice dinner or a weekend off from budgeting. It keeps saving from feeling like a chore and reminds you that every small win is a step closer to unlocking your front door.

Bottom line: saving for a house takes time, but steady habits and intentional choices make the journey manageable. Whether you lower bills, cut small expenses, earn extra income, or automate your savings, every decision brings you closer to your future home.

What Is the Median Home Price in the Midwest?

Home prices in the Midwest are generally more affordable than in many other parts of the country, which is one reason so many buyers choose to settle here. Lower housing costs mean you can save for a down payment faster, enjoy more space for your money, and manage monthly mortgage payments with greater ease.

According to recent data from Zillow (2025), most Midwest states fall well below the national average home price of around $363,932, making the region a smart and practical choice for both first-time and repeat buyers. Here's a look at the current averages by state:

Average House Price in Ohio

Ohio continues to be one of the most affordable housing markets in the Midwest. With an average home price of about $240,288, buyers can find comfortable, family-sized homes at prices far below coastal markets.

Cities like Columbus, Cleveland, and Cincinnati offer a mix of affordable suburban neighborhoods and revitalized urban areas. This affordability makes it possible for many buyers to save for a 10% down payment in just a few years while still enjoying a strong job market and low cost of living.

Average House Price in Illinois

The average home price in Illinois is around $283,509, although prices can vary a lot between cities and smaller communities. Homes in Chicago's suburbs usually cost more, while properties in rural areas and small towns are often much more affordable.

Illinois offers a wide mix of homes, from older historic houses to brand-new builds, so buyers can choose what fits their budget and lifestyle. Even with slightly higher property taxes, the state's competitive home prices and strong job opportunities make it a solid choice for Midwest homeownership.

Average House Price in Pennsylvania

In Pennsylvania, the average home price sits at approximately $281,783, offering great value for buyers who want access to both urban convenience and small-town charm.

Areas like Pittsburgh and Harrisburg remain especially affordable compared to East Coast cities such as New York and Washington, D.C. Pennsylvania's stable housing market and moderate cost of living also appeal to families and retirees seeking long-term security and strong community ties.

Average House Price in Michigan

Michigan's average home price is about $258,642, which makes it a budget-friendly option for many homebuyers. The state offers plenty of choices, including lakeside cottages, suburban homes near Detroit, and affordable properties in cities like Grand Rapids and Lansing.

Michigan's low cost of living, natural scenery, and access to year-round outdoor activities make it an attractive place for buyers who want both affordability and a great quality of life.

When You Finally Get the Keys, Don't Overlook Your Utilities!

After all the saving and planning you put in, getting the keys to your new home feels incredible. But before you settle in, there is one important step that is easy to forget: setting up your utilities. Making sure your energy service is ready ahead of time can take a lot of stress out of moving day.

As a trusted Midwest energy supplier, we at Santanna Energy Services make it easy for homeowners to choose a plan that fits their lifestyle and budget. Whether you want predictable supply charges through our Unlimited Energy Plan* or prefer the stability of a fixed-rate plan, we help you avoid surprises and keep your energy costs steady month after month.

And when you move, we make the transition simple. Our team can help you compare options and enroll quickly, so you can focus on settling into your home.

When you're starting fresh in your new home, having the right energy partner makes a big difference. With Santanna Energy Services, you can power your home confidently and focus on enjoying the next chapter you've worked so hard for.

Energy-Efficient Budgeting Tips to Save More for Your Home

Saving energy doesn't have to be complicated or expensive. Small, consistent habits can lower your monthly bills and help you save for your future home faster. These practical tips can make a real difference for any Midwest household:

- Switch to LED Bulbs: Replace older bulbs with LED lighting. LEDs use less electricity and last much longer, which helps lower your energy use week after week.

- Unplug Unused Electronics: Many devices continue to draw power even when turned off. Plug small electronics into a power strip and switch it off when you are not using them to avoid wasted energy.

- Adjust Your Thermostat: Set it around 70-78 degrees in summer and 68-70 degrees in winter to save on heating and cooling costs. A programmable or smart thermostat can automate this.

- Seal Air Leaks: Use caulk or weatherstripping to seal gaps around windows and doors. This keeps the air in your home cool and reduces strain on your heating and cooling systems.

- Lower Your Water Heater Temperature: Set your water heater to 120°F. This temperature is safe for daily use and helps reduce energy waste from overheating water.

- Wash Clothes in Cold Water: Modern detergents work well in cold water, so using this setting can cut your energy use without affecting cleanliness.

- Run Full Loads: Use your dishwasher and washing machine only when they are full. This makes each cycle more efficient and reduces water and electricity use.

- Take Shorter Showers: Limit your shower time to save water and reduce the energy needed to heat it. Even a small adjustment each day can make a noticeable difference.

- Air-Dry Your Clothes: Skip the dryer whenever possible and let clothes dry naturally. This reduces energy use and helps your clothes last longer.

- Cook Efficiently: Use a microwave, slow cooker, or toaster oven for smaller meals. These appliances use less energy than a full-sized oven.

- Turn Things Off When You Leave the Room: Make it a habit to switch off lights, fans, and small appliances. It is one of the simplest ways to reduce electricity usage.

- Use Curtains Wisely: Close curtains on hot summer days to block heat. In winter, open them during sunny hours to let natural warmth inside.

- Maintain Your HVAC System: Replace or clean your air filters every 1-3 months. Clean filters help your heating and cooling systems run more efficiently.

- Add Insulation: Upgrading insulation in your attic or walls can significantly reduce heating and cooling costs. It also keeps your home more comfortable throughout the year.

- Install a Smart Thermostat: A smart thermostat learns your daily routine and automatically adjusts temperatures. This helps you save energy without having to think about it.

These small adjustments might save you about $25 – $50 a month, which adds up to roughly $300 – $600 a year that can go straight into your home savings. By managing your energy use wisely, you save more for your future home and build habits that keep your next place efficient and affordable.

Saving for a home takes patience, planning, and practical choices. From setting clear financial goals to managing everyday expenses, each step helps you move toward homeownership with confidence.

Knowing your local housing market, preparing for utility costs, and building simple energy habits can make the entire process easier, especially in the Midwest, where affordability and stability often go hand in hand.

As you work toward your dream home, remember that stability continues even after you buy. How you manage your household expenses plays a big role in your long-term comfort, and Santanna's Unlimited Energy Plan can help you stay in control. With predictable monthly supply charges*, you can enjoy peace of mind knowing your supply charges will stay steady throughout the year.

Take a moment to explore how Santanna's Unlimited Energy plan can keep your budget predictable and bring more balance to your home life, so you can focus on building your future with confidence.

* Restrictions apply. Enrollment based upon program eligibility. Customers using more than 125% of normal monthly usage as determined by Santanna may be required to switch plans.

Tyler is an experienced energy professional, having worked for Santanna Energy Services, for the past four years. He is passionate about renewable energy and believes that diversifying the energy grid is the key to a sustainable future. Tyler is dedicated to supplying consumers with the best possible energy solutions and works diligently to make sure that Santanna can deliver the highest quality service.