The Pros and Cons of Budget Billing

by Tyler Castle

6.8 min read

Managing monthly expenses can be a balancing act. While payments like your rent and mortgage might stay the same, your utilities likely don’t. Budget billing offers a solution that aims to help you navigate the peaks and valleys of utility costs.

But is this payment strategy right for you? We’re here to lay it all out for you by exploring budget billing and its pros and cons. Whether you’re a budgeting pro or just starting to navigate your finances, we’re here to offer friendly guidance to help you understand this billing method better.

Key Points of This Article:

- Budget billing evens out monthly utility payments by using a customer’s past yearly energy usage to create a consistent monthly amount.

- This approach helps with budgeting and reduces stress by avoiding seasonal bill spikes, and it can be paired with autopay for convenience.

- Downsides include possible fees, losing track of actual usage, owing a year‑end balance, credit or history requirements, and complications if moving.

- Budget billing does not save money, so customers should review their contract, assess their finances, and consider alternatives like self‑budgeting or predictable‑rate plans.

What is budget billing?

Budget billing is a payment arrangement made by most (not all) utility companies. This plan aims to help customers manage their monthly expenses. This means that customers pay the same amount each month, making it easier to budget for utilities. This plan helps customers balance out their monthly bills when prices rise during peak times like summer and winter in colder areas.

How does budget billing work?

To calculate your monthly billing amount, a utility company will look at your energy consumption over the past year. They will then calculate the average amount and use it as a benchmark for your monthly budget billing amount. In other words, instead of fluctuating bills based on your actual monthly usage, this plan spreads out your energy cost evenly over the course of a year. This can help you budget your money more effectively.

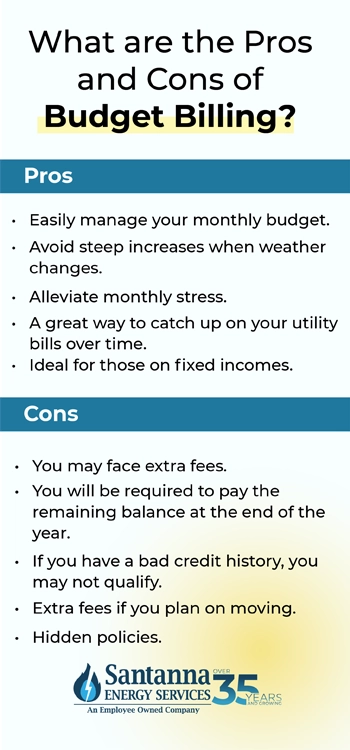

What are the pros of budget billing?

If you’re considering budget billing, here are a couple of pros to keep in mind before you commit to a plan:

- While it won’t save you money, budget billing may allow you to more easily manage your monthly budget.

- You won’t pay steep increases in energy rates during the warmest or coldest months in your region when you use more power.

- In some cases, you can combine budget billing with autopay so you can “set and forget” paying for your utility bills each month.

- This plan can alleviate monthly stress. You may avoid the stress of not knowing what your bill will be or whether you’ll have enough funds to pay it.

- Budget billing can serve as a great way to catch up on your utility bills over time.

What are the cons of budget billing?

While this plan type might seem ideal for some, this program does come with its cons:

- Depending on who you sign up with for your plan, you may face extra fees.

- This payment strategy can cause some to become complacent with their usage. With your utility bills out of sight, out of mind, you might not keep track of your energy usage. This can cause you to pay more later on.

- If your energy bills for the year exceed your monthly payments, you will be required to pay the balance due. This defeats the purpose of budget billing and creates a real hardship for some customers on fixed incomes.

- All plans are different. Some may require a minimum 12-month billing history with the current utility company. If you have a bad credit history, you may not qualify or get kicked out of your budget plan.

- Depending on the timing and terms of your contract, there could be complications and extra fees if you plan on moving.

- Make sure you read the contract carefully and understand all the terms and conditions. Some contracts may catch you off guard with hidden policies.

Is this plan right for me?

Ultimately, deciding if budget billing is right for you depends on your lifestyle and financial situation. According to The Penny Hoarder.com, this plan can be ideal for those who are on a stricter budget. This plan might also be ideal for those who are worried about late payments that might be affecting their credit score.

A budget billing plan might be beneficial when you have the capability to cover your utility expenses but still face challenges in finding money for them.

Does budget billing save you money?

Contrary to what you might think, budget billing DOES NOT save you money on your bills. This budgeting plan is simply a way to make your bills each month more predictable. Before you enroll in a budget billing program, it’s important to assess your financial situation and do your research.

Do your homework before signing up

While budget billing can be a helpful budgeting tool, be sure to conduct extensive research before you sign up. The biggest thing to keep in mind if you’re looking to budget your electric or gas is not all utility companies offer a budget billing program. If you’re satisfied with your energy service but interested in enrolling in a budget billing program, it’s advisable to stick with your current energy provider even when they don’t offer a program. This is because budget billing doesn’t result in cost savings.

In some cases, budget billing isn’t free and might require a small fee. Be sure to read your contract carefully before signing up. Lastly, if you’re currently with a budget billing program and no longer need it, you could put yourself at risk for an extra charge.

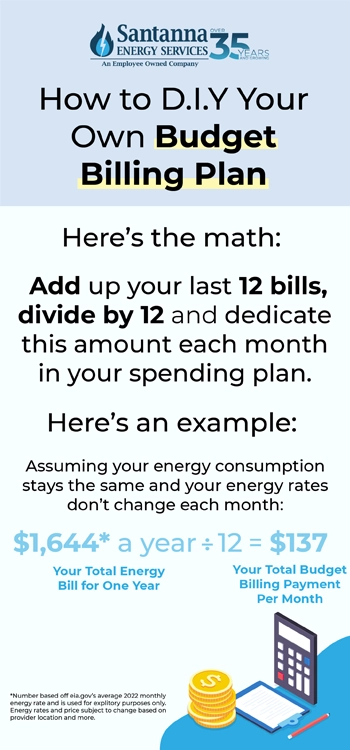

If you’re not sure about this budgeting tool, you can DIY it! All it takes is a little math:

Is it worth it?

So, is budget billing worth it? It all depends on your financial situation. If you’re in need of a little help with managing your expenses, budget billing might be worth it. If you want consistent and predictable monthly payments, especially if you have a fixed income, this budgeting strategy could be beneficial.

However, it’s essential to consider that budget billing may not always result in cost savings, as this program is typically designed to even out your payments over the course of a billing cycle. Ultimately, weighing the pros and cons, as well as considering your own financial goals and preferences will help you determine if budget billing is worth it for you.

Alternatives

If this budgeting solution isn’t your cup of tea, there are other ways you can budget for your utility expenses:

Self-Managed Budgeting: Rather than relying on the utility company, you can create and track your own budget for utility expenses.

Automate Your Savings: Set up automated transfers into a dedicated savings account specifically for utility expenses and build a buffer to cover fluctuations in your bills.

Conduct a DIY Energy Audit: By assessing your home’s energy efficiency, you can identify areas for improvement that can potentially reduce your overall energy consumption and lower your bills.

Choose an Energy Plan That Has Predictable Billing: Many energy providers offer plans with no surprises. For example, an Unlimited Energy plan, also known as Flat Fee plan, allows you to pay the same monthly amount.* This is so you know exactly what to budget every month for your energy bill.

Santanna Energy Services is a supplier of earth-friendly natural gas plans in the United States, providing services to Illinois, Indiana, Pennsylvania, Michigan, and Ohio. We provide a wide range of energy services and products to meet the needs of both residential and small business customers. Our mission is to provide innovative and cost-effective energy solutions that will help our customers achieve their energy goals. With over 35 years of experience, we are committed to creating life-long relationships by providing quality service to customers, communities, and employees.

* Restrictions apply. Enrollment based upon program eligibility. Customers using more than 125% of normal monthly usage as determined by Santanna may be required to switch plans.

Tyler is an experienced energy professional, having worked for Santanna Energy Services, for the past four years. He is passionate about renewable energy and believes that diversifying the energy grid is the key to a sustainable future. Tyler is dedicated to supplying consumers with the best possible energy solutions and works diligently to make sure that Santanna can deliver the highest quality service.