What Does Contingent Mean on a House Sale? A Homebuyer’s Guide to Next Steps, Including Energy Setup

by Jenna Mendez

23.8 min read

You find your dream home online; it's in a great neighborhood, within budget, and just listed. But then you see a status you weren't expecting: "Contingent." Now you're left wondering, what does contingent mean on a house sale, and does it mean you're already too late?

Don't worry, we've got you covered with what you need to know. At Santanna Energy Services, we've been helping homeowners across the Midwest for decades, guiding more than 500,000 customers through important decisions about their energy needs and what's right for their home.

With that expertise, we can help you understand what contingent really means and how it affects your utility setup, like electricity or gas.

Continue reading to gain a clear understanding of what contingent really means and what to do before it's too late.

Key Points of This Article:

- A "contingent" status means the seller has accepted an offer, but the sale is not yet final.

- A house sale that's contingent on inspection protects buyers from costly or unsafe repairs.

- HOA contingencies let buyers back out if fees or rules clash with their lifestyle or budget, and you can still make an offer on a contingent home.

- Most contingent deals succeed; only 5–10% fall through before closing.

- If sellers fail to complete promised repairs, you can delay closing, request escrow funds, or walk away.

What Does Contingent Mean on a House Sale?

In real estate, when a home is marked as contingent, it means the seller has accepted an offer from a buyer, but the sale isn't final yet. It will only move forward if certain conditions are met. If you're wondering what a contingent offer on a house is, think of it like booking a vacation with a refundable deposit: you've reserved your spot, but the trip won't happen unless all the details are confirmed.

For example, the buyer may still need to secure a mortgage, the home may need to pass an inspection, or the seller may need to resolve a title issue.

Until those conditions are met, the sale isn't final. The deal can still move forward, face delays, or fall apart entirely, so it's important for both sides to stay flexible and proactive.

According to Zillow, real estate contingencies are designed to protect your earnest money (a good-faith deposit you put down when making an offer on a home).

If something goes wrong, like the inspection reveals major issues or your financing falls through, a contingency allows you to back out of the deal without losing that deposit, which is typically 1%–3% of the purchase price.

Contingencies also give buyers leverage to renegotiate or request repairs if new issues come up during the process. In fact, Zillow confirms that nearly 98% of homebuyers include at least one contingency in their offer, showing how common and important these safeguards are during a home purchase.

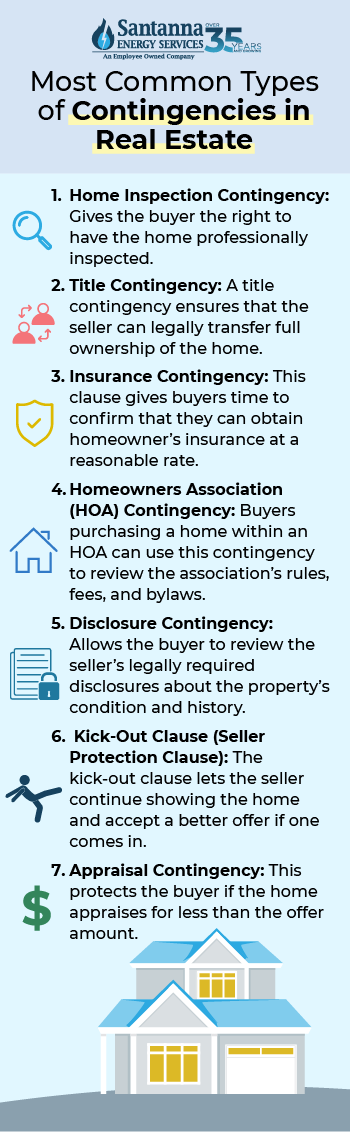

Most Common Types of Contingencies in Real Estate

Each contingency gives either the buyer or seller a level of legal and financial protection. Think of them as safety nets; they protect buyers from buying a home that isn't the right fit, and they protect sellers from wasting time on buyers who can't follow through.

However, they also add complexity to the offer and can impact the timeline, the likelihood of closing, and the overall appeal of your offer in a competitive market. Here's a breakdown of the most common types of contingencies in real estate you'll come across and why they matter:

1. Home Inspection Contingency

This contingency gives the buyer the right to have the home professionally inspected and either renegotiate the terms or cancel the deal if serious issues are found, such as structural damage, roof leaks, or plumbing problems.

A house sale that's contingent on inspection gives the buyer a safeguard, ensuring they don't unknowingly commit to a property that may require costly or unsafe repairs.

To stay on track, we recommend you schedule your home inspection early, usually within the first few days after the offer is accepted. Be sure to use the findings from your home inspection to request repairs, ask for credit, or adjust the purchase price before moving forward if you find something seriously wrong.

2. Title Contingency

A title contingency ensures that the seller can legally transfer full ownership of the home, free of liens, unpaid taxes, or ownership disputes.

A clean title is crucial to avoid legal problems such as disputes over ownership, unpaid property taxes, outstanding mortgages, or claims from heirs or ex-spouses after closing. To manage this, have a title company conduct a thorough title search and require the seller to resolve any issues before moving forward.

3. Insurance Contingency

This clause gives buyers time to confirm that they can obtain homeowner's insurance at a reasonable rate. In areas prone to floods, fires, or severe weather, coverage can be expensive or even denied, which affects affordability. Request insurance quotes as soon as the offer is accepted to avoid last-minute coverage issues.

4. Homeowners Association (HOA) Contingency

Buyers purchasing a home within an HOA can use this contingency to review the association's rules, fees, and bylaws. If there are any restrictions or conflicts with the lifestyle of a homeowner's HOA, they can cancel the contract. To protect yourself, review all HOA documents carefully and consult your agent if anything raises concerns.

5. Disclosure Contingency

This contingency allows the buyer to review the seller's legally required disclosures about the property's condition and history. If serious issues, such as past flooding or foundation repairs, are revealed, the buyer may cancel the deal without penalty. Always read disclosure statements thoroughly to make an informed decision about moving forward.

6. Kick-Out Clause (Seller Protection Clause)

Used in offers that include a home sale contingency, the kick-out clause allows the seller to continue showing the home and accept a better offer if one is received. The original buyer then has a limited window, typically up to 72 hours, to remove their contingency or walk away. Coordinate your timelines carefully and be ready to act fast if another buyer enters the picture.

7. Appraisal Contingency

This protects the buyer if the home appraises for less than the offer amount, ensuring the lender isn't over-financing a property. If the appraisal comes in low, the buyer can renegotiate the price, pay the difference, or cancel the deal. Be sure to stay flexible and work with your agent to adjust the offer if needed or walk away if the gap is too large.

Common Contingent Statuses on Listings

If you're browsing listings and notice a home marked "contingent," don't be discouraged because it might not be off the table just yet. These common contingent statuses on listings tell you how far along the sale is and whether the seller is still open to other offers. Here's what each one means for you as a buyer:

Contingent – No Show

This means the seller has accepted an offer and is no longer allowing showings. The home is temporarily off the market while the buyer works through their conditions, like inspections or loan approval. While it's not likely you can step in with a new offer, it doesn't hurt to ask your agent to monitor the listing in case the deal falls through.

Contingent – Continue to Show (CCS)

In this case, an offer has been accepted, but the seller is still showing the home to other buyers. They're essentially keeping a backup plan in place. If you're interested, you can still schedule a showing and submit a backup offer—especially if you're ready to move quickly or don't need as many contingencies.

Contingent – Kick-Out Clause

Here, the buyer's offer includes a contingency, often meaning that they must sell their current home first. However, the seller has the right to "kick out" that buyer if someone else makes a better offer. As a new buyer, if you're able to waive certain contingencies (like the need to sell your own home), you may have a better chance of winning the deal.

Contingent – Short Sale

At this status, the seller has accepted an offer for less than what they owe on their mortgage, usually to avoid foreclosure. These types of sales require lender approval, which can add time and uncertainty to the process.

If you're considering a home in this category, be prepared for a potentially longer process and make sure your financing timeline is flexible.

Can You Make an Offer on a Contingent Home?

The short answer is yes, you can absolutely make an offer on a home that's listed as contingent. While the seller has already accepted an offer, there's still a chance the current deal could fall through, especially if the buyer is slow to meet deadlines or struggles with financing or inspection issues.

If the seller is motivated or concerned about delays, your backup offer, especially if it's stronger, cleaner, or comes with fewer contingencies, might catch their attention.

In some cases, if your offer is more appealing, the seller may activate a kick-out clause (if one exists) to give the current buyer a deadline to move forward or step aside.

If your offer is accepted and you're financing the home, you'll continue with the standard steps required by your lender. But if you're offering cash, the process could move much faster, potentially allowing you to close quickly and with fewer complications.

How Do You Make an Offer on a Contingent Home?

Even though a home is already under contract, there's still a chance you can buy it if the current deal falls through. Here's how you make an offer on a contingent home:

Step 1: Talk to Your Agent

Start by discussing the property with your agent to understand where the deal stands. They can check whether the seller is welcoming backup offers, which is commonly acceptable when a listing includes a kick-out clause (also known as an escape clause). These clauses allow the seller to continue marketing the home and accept a stronger offer if necessary.

Step 2: Confirm Showing Permission

Ask if the seller is still letting potential buyers tour the property. Some listings allow continued showings, while others have stopped accepting viewings. Knowing whether the home is still accessible gives you an idea of how serious the primary buyer is and how motivated the seller might be to consider another offer.

Step 3: Submit a Formal Backup Offer

If the seller is open to it, you can move forward by submitting a formal written backup offer. Treat this just like you would a primary offer by including your own contingencies, such as inspection or financing, and be prepared to submit an earnest money deposit to show you're serious.

It's important to clearly state in the contract that your offer will only become active if the first offer falls through. That way, if the current deal collapses, your offer can take its place immediately without the seller needing to relist the home or start from scratch.

Step 4: Stay Flexible on Timing

Contingent deals can drag out, depending on inspections, financing, and seller allowances. Let your agent know you're flexible with closing dates or inspection timelines. This makes your offer more appealing in case the seller wants to move quickly once they receive notice that their original deal fell through.

What Does It Mean When a House Is Pending?

When a home is marked as pending, it means the seller has accepted an offer and all major conditions (like inspections, financing, or appraisals) have either been completed or waived.

At this point, the home is no longer considered "active" on the market. This period typically lasts between a week and two months, depending on how quickly everything comes together.

Buyers can still cancel the contract but there are rules. If all contingencies have already been cleared, the buyer can walk away, but they may lose their earnest money deposit.

If you see a home marked as "pending," it's okay to keep an eye on it, but it's smart to focus on homes still listed as "active" or "contingent," where you may still have a chance to compete.

Common Pending Statuses in Real Estate

Here are the most common pending statuses in real estate you'll come across and what they actually mean:

1. Pending – Taking Backups

This means the seller has accepted an offer, and all or most contingencies may have been met, but they're still open to receiving backup offers. This could be due to concerns about financing, inspection results, or the buyer's readiness. If you're a buyer, this is your best chance to submit a backup offer, just in case the current deal falls through.

2. Pending – No Showings

This status means the home is under contract and the seller is no longer allowing showings. It typically indicates that the deal is strong, and the seller is confident it will close. At this point, the home is essentially off the market. You can still monitor it in case it returns to an active status, but it's unlikely that the seller will accept other offers.

3. Pending – Short Sale

In this case, the seller has accepted an offer, but the home is being sold for less than what they owe on their mortgage. Because of this, the lender must approve the deal, and that can take extra time. Short sales are more complicated. Even if it's marked pending, the deal could fall through if the bank doesn't approve the offer, which may take weeks or even months to finalize.

4. Pending – Subject to Lender Approval

This is often used in short sales or distressed properties, where the offer is not yet fully approved by the lender or bank. It's a waiting game. Just as with short sales, you'll need patience and be prepared in case the deal takes longer than expected or the seller's lender declines the offer.

5. Pending – Overdue or Delayed

Some homes are marked as pending when they're almost sold, but if things take too long, the MLS (Multiple Listing Service), where real estate professionals use to manage home listings, may label them as pending overdue. These listings mean the sale is behind schedule but could possibly come back on the market. It's worth asking your agent to keep an eye on them if you're still interested.

Can You Make an Offer on a Pending Home?

Yes, it is technically possible to make an offer on a home that's in pending status, but it's important to understand that your chances of success are very limited at this stage.

Once a sale reaches the pending phase, it typically means all contingencies have been cleared, and both the buyer and seller are simply waiting to close. In most cases, the seller is no longer showing the home, so if you didn't visit the property while it was still active, you may be putting in an offer without ever seeing it in person.

However, there are exceptions. If the seller has concerns that the current buyer might not make it to the finish line due to financing delays or last-minute issues, they may be open to backup offers.

How Long Does a House Stay in Contingent Status?

If you're wondering how long a house stays in contingent status, the answer typically depends on the terms outlined in the purchase agreement. Most contingency periods last between 30 and 60 days, though the timeline can vary depending on the complexity of the offer and the contingencies involved.

For example, if the buyer's offer includes a mortgage contingency, the lender usually sets a deadline to finalize loan approval about a week before the scheduled closing date.

During this phase, several critical steps take place behind the scenes to move the transaction forward.

The home inspection is completed, and if any issues are discovered, the buyer and seller negotiate repairs or credits. The lender orders an appraisal to confirm the home's market value and ensure the loan amount is justified. Meanwhile, loan underwriting begins, which involves verifying the buyer's income, assets, credit score, and debt-to-income ratio.

If applicable, the buyer also reviews property disclosures and Homeowners Association (HOA) documents to ensure there are no red flags. Throughout the process, both real estate agents track contingency removal deadlines carefully to avoid delays.

So, while the home is marked as "contingent," it's not just sitting idle; the contingent status is an active and crucial phase in the home sale journey where important due diligence and final deal-shaping tasks are being completed.

How Often Do Contingent Offers Fall Through?

Contingent offers generally have a high success rate, with only about 5% to 10% of real estate deals falling apart before closing, based on our industry research.

However, when a deal does fall apart, it's usually due to financing issues (such as the buyer's loan being denied during final underwriting), problems uncovered during the home inspection (like structural damage or safety concerns), or a low appraisal that causes the lender to reduce or withhold funding.

These situations can create setbacks, especially if the buyer is unable to resolve them within the agreed-upon contingency window.

What is The Role of Contingencies in Real Estate Negotiations?

The role of contingencies in real estate negotiations is not just a critical part of the back-and-forth process that happens when a buyer and seller agree to a home sale, but also plays a major role in shaping the timeline, risk, and flexibility of the transaction.

Based on data shared by Columbus GA Real Estate, the National Association of Realtors (NAR) found that roughly 76% of homebuyers include at least one contingency in their purchase agreement. Additionally, about 4% of pending sales fall through because certain contingencies aren't met or resolved in time.

Contingencies give you leverage and peace of mind, but too many can make your offer less attractive in a competitive market. For example, a seller might prefer a slightly lower offer with fewer contingencies if it means the deal is more likely to close quickly.

Advantages of Contingencies for Homebuyers

While some buyers worry that including contingencies could make their offer less competitive, especially in hot markets, they offer valuable safeguards that can help you avoid costly mistakes and increase your confidence in the purchase. Here are some of the best advantages of contingencies when purchasing a home:

1. Financial Protection

Contingencies provide key financial protections during the homebuying process. They help keep your deposit safe if something goes wrong, such as loan denial or major repair issues. In that case, you can cancel the deal without losing your earnest money.

An appraisal contingency prevents you from overpaying by allowing you to renegotiate or walk away if the home's appraised value comes in lower than the agreed price, while a title contingency ensures there are no unpaid liens or legal issues tied to the property. Lastly, a financing contingency provides time to secure your mortgage and protects you if the loan doesn't go through. All this helps protect you from potential financial burdens.

2. Negotiation Power & Flexibility

Contingencies also offer buyers more flexibility and leverage in the negotiation process. If something unexpected happens, you have the option to back out or negotiate with the seller for repairs, credits, or a price reduction.

The contingency period gives you the time needed to complete inspections, finalize your loan, or sell your current home without being rushed. In situations where you're relying on the sale of your current home, a home sale contingency makes sure you're not left juggling two mortgages if that sale doesn't go through on time.

3. Confidence & Smarter Choices

Contingencies offer peace of mind, so you're not locked into a risky deal. Important protections, such as inspection and appraisal contingencies, ensure that you're not purchasing a home that's overpriced or in poor condition. With these safety nets in place, you can feel more confident that the home you're buying is the right financial and structural fit for your future.

House Sale Contingent on Inspection: What That Means

When you see a house sale contingent on inspection, it means the buyer's offer depends on a successful home inspection.

This is one of the most common contingencies in real estate because it helps protect the buyer from moving forward with a home that might have costly, dangerous, or unexpected issues. It provides peace of mind and also encourages sellers to be upfront about the property's condition.

A home inspection contingency gives the buyer the right to hire a licensed home inspector to thoroughly check the home's condition after the seller has accepted their offer. This typically includes the roof, foundation, plumbing, electrical, HVAC systems, appliances, and overall structure.

The purpose of an inspection is to uncover any hidden issues that might not be visible during a walk-through. The contingency lets the buyer renegotiate, request repairs, or back out of the deal entirely if major problems are found—without losing their earnest money deposit.

Most inspection contingencies are set for 7 to 10 days after the offer is accepted, but the exact window depends on what's written in the contract. If repairs are requested, sellers can agree, counter, or decline. If an agreement can't be reached, the buyer may cancel the contract.

When to Walk Away After a Home Inspection

Sometimes, the problems uncovered during an inspection, like mold, asbestos, or major structural issues, are just too big or expensive to deal with. In these cases, it's often smarter to walk away.

That's why most real estate contracts include an inspection contingency: it lets you cancel the deal and usually get your earnest money back.

If the seller refuses to fix major issues or doesn't follow through with promised repairs before closing, you can delay the sale, ask for funds to be held in escrow, or decide to walk away to protect yourself from future problems.

Why the Contingent Phase Matters for Utility Setup

Once your offer is accepted and the home enters the contingent phase, you might feel like it's too early to think about electricity or gas. But in reality, this is the ideal time to start preparing your utility setup, especially if you're moving into a new home in a deregulated energy state like Ohio, Illinois, or Pennsylvania. Here's what you should do:

- Start by confirming your closing timeline with your real estate agent, as this will help you plan key steps without jumping ahead too soon.

- Next, begin researching local utility providers and energy suppliers, particularly if you live in a deregulated state like Illinois, Ohio, or Pennsylvania, where you can shop for your electricity or gas plan.

- Use this time to compare energy plans, which can help protect you from seasonal rate hikes or allow you to choose a plan more in line with your lifestyle.

- Once you have a tentative closing date, contact the utility to set a start date just before move-in. When you get a Utility Account Number from your utility, you can then enroll with an energy supplier.

Taking these steps early helps avoid delays, rushed decisions, and move-in day stress.

How to Set Up Your Utilities in a Contingent House

Even if your home sale is still in the "contingent" phase, it's not too early to prepare your energy plan. Planning now helps avoid move-in delays. Here's what to do:

1. Confirm Your Closing Date Window

While your sale is still contingent, the exact closing date might shift depending on inspections, financing, or other conditions.

Once you have a tentative closing week, you can start researching energy plans.

2. Check If You Can Choose Your Energy Supplier

Deregulated markets in the Midwest, such as Ohio, Pennsylvania, and Illinois, allow you to choose your energy supplier separately from your utility company.

Use your new home's address to find eligible electricity and natural gas suppliers in your area.

3. Compare Plans and Pre-Select Your Favorite

You can't enroll until you have received your Utility Account Number from your utility company. However, you can research suppliers, compare plans, and determine which option best suits your budget and energy needs. That way, you can finalize enrollment as soon as you get your account number, helping you avoid default utility rates.

4. Understand Who Sets Your Start Date

When you enroll in an energy plan, it's important to know that the supplier doesn't set your service start date; your local utility company assigns it. This means even if you choose your plan and submit your enrollment, the utility still controls when your service officially begins.

To make sure things go smoothly, enroll with your supplier promptly after closing so they can submit the request without delay. It's also smart to ask your supplier to confirm your utility-assigned start date so there are no surprises. Keep in mind that some utilities may require a meter read or other steps before your plan can be activated.

4. Have a Flexible Move-In Plan

If your closing date changes—which often happens—the start date for your energy service may shift as well. Because energy enrollment typically requires a Utility Account Number, you can't "pre-enroll" weeks in advance and then cancel without consequences.

Instead, the best approach is to wait until you've closed on the home to submit your enrollment. To avoid delays, take notes on your preferred energy plan ahead of time so you're ready to act quickly once the closing is complete. And if you're on a tight timeline, don't worry, you may be placed on the utility's default rate temporarily until your selected plan kicks in.

FAQs

Are contingencies common?

Yes, contingencies are the norm, not the exception. Today, they remain widely used to protect buyers from major financial or inspection issues.

What's the most common contingency in a home purchase contract?

The home inspection contingency is the most frequently used protection. In a study by The National Association of Realtors, about 75% of buyers included it in their offer. Appraisal and financing contingencies follow closely behind.

Who's most affected by contingencies?

Those most affected by contingencies are typically owners, contractors, and project managers. Contingencies, which are funds or time allocated to address unforeseen issues, can impact these parties in various ways.

Can you outbid a contingent offer?

Yes, if the seller is still accepting backup offers, you can submit a stronger or cleaner bid that may replace the original. This is possible in contingent listings with a kick-out clause, which gives the seller the right to cancel the current contract if a better offer comes in.

Is it worth looking at a house that is contingent?

Yes, especially if backup offers are permitted. While the original offer often closes, a strong backup offer may give you a second chance if the sale falls through.

Does pending mean sold?

Not quite. A pending status means all contingencies have been cleared and the sale is moving toward closing. But until the closing paperwork is signed, it's not officially sold.

Why would a home go from pending back to contingent?

This happens when unexpected issues arise after all contingencies were thought to be cleared, like financing delays or unresolved title problems. The result is a temporary pause that returns the listing to contingent status.

Can a seller back out of a contingent offer?

This can only happen if the buyer fails to meet the agreed-upon contingencies (e.g., financing or timeline). Otherwise, once crisply written into the contract, the seller is bound unless the buyer doesn't fulfill the terms on time.

Am I protected if I'm in a contingent deal?

Yes, contingencies build in protection. If the buyer meets the required deadlines or conditions, they can withdraw or renegotiate without losing their earnest money. Just be sure to understand each clause and its timeline.

Should I remove or waive a contingency?

Most experts advise against waiving the financing contingency unless you're buying the home with cash.

Whether you're buying, selling, or somewhere in the "contingent" middle, preparing to set up your utilities early can save you from last-minute headaches. From rate protection to renewable options, having your energy plan lined up means one less thing to stress about, so you can focus on enjoying your new home. Explore our available energy plan in your area so your home feels like home on day one.

Jenna Mendez is a Midwest native with lifelong roots in Illinois and time spent in Ohio during college, giving her a deep understanding of the Midwest region’s people, climate, and energy needs. She brings firsthand experience and local insight to topics that matter to Midwest homeowners, especially energy efficiency, sustainability, and home living. Jenna specializes in writing about eco-friendly living, all things Midwest, renewable energy, and practical ways to reduce energy costs. Jenna brings a trusted, and local hometown voice to every article she writes, helping readers live well, and sustainably, right where they are.