What are Sinking Funds: Purpose, Types, & Budgeting Tips

by Tyler Castle

7.5 min read

Managing finances can be a complex task, especially when planning for future expenses or large purchases. One effective tool to simplify this process is the sinking fund. But what exactly is a sinking fund, and how can it benefit your financial planning and how can you start one?

You’re in the right spot as we’re about to delve into sinking funds for beginners. We’ll break down everything you need to know about this budgeting tool. From how they work, the purpose, and types of sinking funds, we have you covered for what you need to know.

What are sinking funds and how does it work?

A sinking fund is a savings strategy where you set aside a specific amount of money at regular intervals to cover future large expenses or debt. Contributions to your funds are made on a regular basis. But the timeline in which you contribute to these funds depends on you and how you would like to use the money in your sinking fund.

What is the purpose?

The purpose of a sinking fund is to help you set aside money over time for a specific, future expense, reducing the financial burden when that cost arises. This budgeting strategy helps manage large expenses by breaking them down into manageable, periodic savings.

Sinking funds offer a way to add peace of mind to your budgeting and monthly expenses. The worst thing you can do for your budget when unexpected expenses come along is not being prepared. Instead of scrambling to find funds for an unexpected expense or taking on debt, a sinking fund allows you to plan and save incrementally.

Sinking fund categories: what can I use them for?

This budgeting strategy isn’t just used for emergencies, it can be used for anything you’re saving up for. Here are some of the most common sinking fund ideas your money can contribute to:

Home Repairs and Maintenance: Save for major home repair costs, such as roof repairs or HVAC maintenance.

Vacation Planning: This fund type can allow you to set aside money for an upcoming trip. If you have ambitious goals for your vacation, you can even dedicate a separate fund for excursions and perks. This way you know you’ll be covered and won’t have to compromise on fun!

Education Expenses: You can set up a fund to save for tuition fees or school supplies.

Major Purchases: Plan for major purchases like a new car, home appliances, or energy-efficient upgrades to your home.

Utilities and Energy Costs: Create a sinking fund for anticipated increases in utility bills or energy-related home upgrades. For example, if you’re enrolled in a variable-rate plan, you could be subjected to high rate hikes during peak seasons you’ll have to prepare for.

Benefits

Sinking funds offer a variety of benefits if you’re looking to start one. Sinking funds reduces the need to rely on credit or loans for large expenses. Instead of accruing debt or paying interest on borrowed funds, you can use the savings in your fund to pay for these expenses outright. This not only prevents add financial strain, paying things right away can improve your credit score.

As another benefit, sinking funds helps you budget more effectively. Knowing you have funds set aside on a monthly basis can help you budget for other expenses as you’ll have a better understanding of your day-to-day expenses. If an unexpected expense arises, the amount you’ve contributed to your sinking fund could allow you to cover the cost entirely, preventing any impact on your regular monthly budget.

Accidents and unexpected purchases do happen. Having a sinking fund handy provides reassurance that funds are available when needed. This ensures you won’t have to dip into your emergency fund or get yourself in debt trying to pay off your expense.

Sinking fund vs. emergency fund

While sinking funds can be used to cover unexpected expenses, the budgeting tool is mainly used for specific future expenses or planned purchases like vacations and cars.

On the other hand, emergency funds are reserved for unexpected, urgent expenses like medical emergencies or car repairs.

What is a sinking fund in budgeting?

A sinking fund is a budgeting tool used to manage and save for anticipated costs. It helps to allocate funds systematically to prevent financial strain when the expense arises. Incorporating sinking funds into your budget to enhance financial planning and achieve specific financial goals. Most importantly, a sinking fund ensures your regular budget stays on track without any setbacks.

How to start a sinking fund

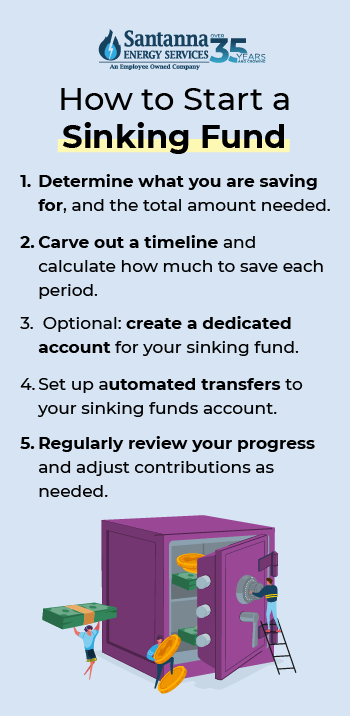

Starting a sinking fund is easier than you think! Here’s a basic process you can follow to start a sinking fund:

- Determine what you are saving for, and the total amount needed. It might help if you write or record what you’re saving for, how much you need, and how much is already in your savings.

- Decide when you need your funds and calculate how much to save each period. Carve out a timeline to ensure you’re saving all you need for when you need to purchase. Write your timeline on paper or in a spreadsheet to keep everything in one place.

- This step is optional, but it could help to create a dedicated account for your sinking fund to keep it separate from other savings. Using the envelope system can also be an effective way to separate your funds or simply recording those funds on a spreadsheet can help too.

- Next, it helps to set up automatic transfers to ensure consistent contributions. This way, you won’t have to remember to make manual deposits, and your savings will grow steadily over time. Many online bank accounts offer the option to schedule automatic transfers directly from your checking account to your sinking fund.

- Regularly review your progress and adjust contributions as needed. Always make sure your money is going to the right place. The worst thing that can happen is going to make your purchase and learning you’re coming up short.

How a sinking fund can help you budget for your electricity and gas costs

Using a sinking fund can help you plan for potential increases in electricity and gas rates. This is especially true if you’re on an energy plan that doesn’t protect you from expecting rates to rise or seasonal fluctuations.

This fund type can help you save energy-efficient home improvements. These additions can include new insulation, energy-efficient windows, or new doors. Planning your sinking funds to contribute to energy-efficient home improvements can save you energy and potentially money from your utility bills in the long run.

Sinking funds allow you to set aside funds for unexpected repairs or replacements related to your energy systems. This can include repairs such as a malfunctioning furnace or air conditioning unit. Including utility bills in your sinking fund strategy can help spread out your utility costs and avoid spikes in your monthly budget.

Tips to save money to contribute to your sinking fund

Create a Budget: Track your income and expenses to identify how far you are from your goal and if you can contribute more to move you closer to your goal.

Use Budgeting Tools: Utilize budgeting tools and tips to help you reach your goal! For example, the 50/30/20 budget rule helps plan for your wants, needs, and savings. Adjusting the percentages to this budgeting tool to account for your sinking fund can help you plan better.

Reduce Unnecessary Spending: Limit discretionary spending on non-essential items like dining out, entertainment, and impulse purchases.

Shop Smart: Use coupons, shop sales, and buy in bulk to save on groceries and household items.

Cut Utility Costs: Implement energy-saving measures at home, such as using energy-efficient appliances, sealing drafts, and adjusting your thermostat. As a bonus, these strategies have the potential to contribute to an eco-friendlier world!

Use Windfalls Wisely: Allocate bonuses, tax refunds, or other unexpected income directly to your sinking fund.

Review Subscriptions: Cancel or downgrade subscriptions and memberships that you don’t use frequently.

Pack Lunches: Save money by bringing homemade meals to work instead of eating out.

DIY When Possible: Take on do-it-yourself projects for home maintenance and repairs to save labor costs.

Incorporating sinking funds into your financial planning brings an invaluable sense of predictability. By consistently setting aside money for anticipated expenses, you create a cushion that safeguards your budget from being derailed by large costs.

There’s peace of mind in knowing you’ll pay the same monthly supply cost amount for your electricity or natural gas supply without any uncertainty — no matter what. Santanna’s Unlimited Energy option protects your bills from fluctuating supply charges no matter the changes in seasons. For over 35 years, Santanna has served customers in Illinois, Indiana, Pennsylvania, Michigan, and Ohio. Our mission is to provide innovative and cost-effective energy solutions that will help our customers achieve their energy goals.

Tyler is an experienced energy professional, having worked for Santanna Energy Services, for the past four years. He is passionate about renewable energy and believes that diversifying the energy grid is the key to a sustainable future. Tyler is dedicated to supplying consumers with the best possible energy solutions and works diligently to make sure that Santanna can deliver the highest quality service.